A Business line of credit is a revolving loan which you may apply any times and for any purpose. A borrower may draw from the line of credit at any moment, pay it back, and then borrow again

A revolving loan that can be used for any purpose is determined by the lender based on your credit score and the type of line of credit which you apply for. In this post we are sharing an idea on secured and unsecured lines of credit along with their interest rate.

What is Secure Business Line of credit?

The best example of secure loan is gold loan, car loan and home loan. Means A lender has created a lien against a borrower-owned asset in Secure business line of credit. In the event of default, the lender may confiscate or liquidate the asset, which serves as collateral. Means Secure business line of create are secure from both side and lenders have no issue to lend the money.

A secured line of credit can also be obtained by a person or business using assets as security. The bank or a loan provider agency may take possession of and sell the collateral to cover its losses if the borrower fails on the loan that is why a secured line of credit often has a bigger credit limit and a substantially lower interest rate than an unsecured line of credit because provider have confident to getting money back.

What is Unsecured Business Line of credit?

In unsure business line of credit a lender assumes greater risk while securing the loan amount because lender have no option to seizure the assets that is why unsecured business line of credit are difficulty to obtain both organisations and people. In simple credit cards are the best example of unsecured lines of credit. A unsecured business line of credit have high interest value.

That is why lenders are offset and elevated risk by imposing restrictions on the amount that can be borrowed and by raising interest rates.

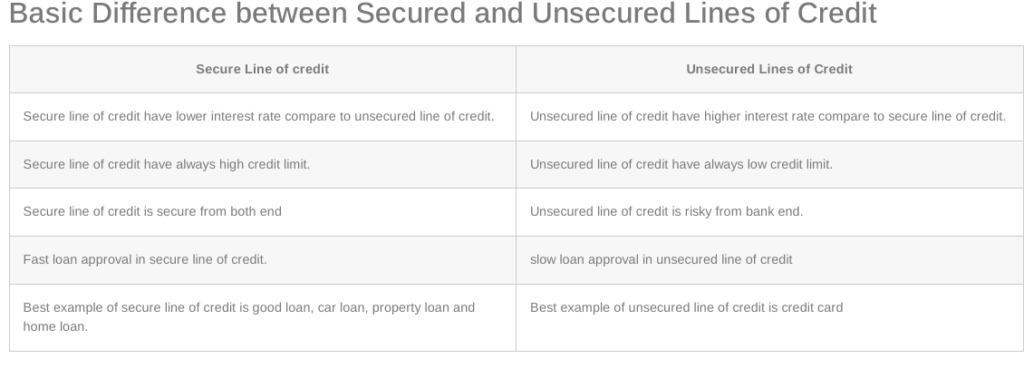

Basic Difference between Secured and Unsecured Lines of Credit

| Secure Line of credit | Unsecured Lines of Credit |

| Secure line of credit have lower interest rate compare to unsecured line of credit. | Unsecured line of credit have higher interest rate compare to secure line of credit. |

| Secure line of credit have always high credit limit. | Unsecured line of credit have always low credit limit. |

| Secure line of credit is secure from both end | Unsecured line of credit is risky from bank end. |

| Fast loan approval in secure line of credit. | slow loan approval in unsecured line of credit |

| Best example of secure line of credit is good loan, car loan, property loan and home loan. | Best example of unsecured line of credit is credit card |

FAQs related to secure and unsecured line of credit

What is the interest rate on an unsecured line of credit?

The interest rate on unsecured line of credit is approx 10 to 30% depending upon, credit score, loan amount and period that loan approved for.

What is the interest rate on an secured line of credit?

Secured credit lines are backed by your assets. Therefore, the interest rate for a secured line of credit is always lower than the interest rate for an unsecured line of credit. It ranges from 3 to 20 percent based on your credit score, the value of your assets, the amount of the loan, and the length of time the loan is approved for.

Is business line of credit a good option?

A business line of credit is a flexible loan that functions similarly to a credit card for businesses. When a loan is approved, the borrower is given a set amount of money that they can withdraw at any time. As long as the owner doesn’t go over the loan limit, they are free to use the money they have on hand. A line of credit is a great choice for companies that need money right now. Once you’ve been approved for a credit line, you can use your available credit whenever you want without having to register.