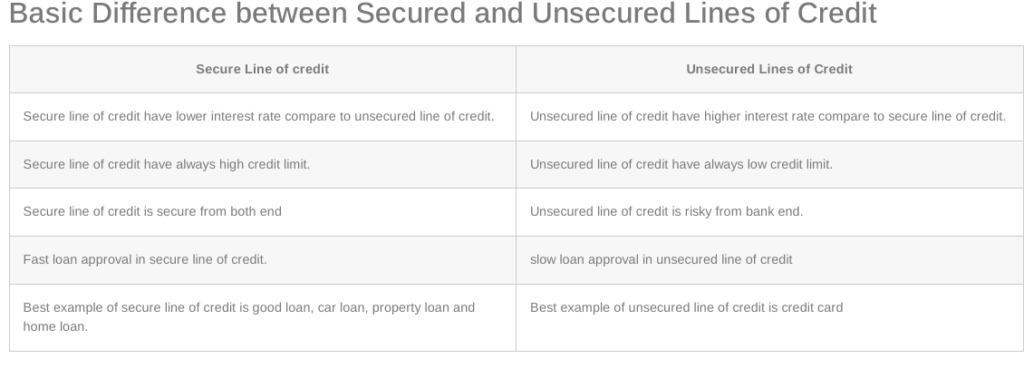

Difference between Secured and Unsecured Lines of Credit

A Business line of credit is a revolving loan which you may apply any times and for any purpose. A borrower may draw from the line of credit at any moment, pay it back, and then borrow again A revolving loan that can be used for any purpose is determined by the lender based on your […]

Advantage and Disadvantage of Equipment Financing

Equipment is one of the essential aspects for any business; without it, the sector’s functionality would be impossible to run smoothly. As a result, any business’s lifeblood is essential for a smooth operation output and consistent cash flow. With the value of the machinery established, it is now necessary to ensure that lifter machine financing […]

Advantage and Disadvantage of Business Line of Credit

A business line of credit is a flexible loan that functions similarly to a credit card for businesses. When a loan is granted, the borrower receives a specific amount of money that they can withdraw at any moment but the owner does not over the borrowing limit, they can use their available cash. For businesses […]

Tips for Small business line of credit

For businesses that require cash quickly, a line of credit is an excellent option. You can use your available credit at any moment and no registration is necessary when you’ve been accepted for a credit line. You know how painful cash flow problems can be if you’ve ever battled to pay payments or passed out […]

Equipment Loan Option For Commercial Business in Chicago

Commercial equipment financing is available at Strategy Lenders for those company who are looking to purchase new equipment, improve old equipment, or just maintain what they already have. Not only Commercial business but have wide range of topics, including computer technology, catering equipment, and many sorts of machinery. What is Commercial Equipment Financing? Commercial Equipment […]